How to Invest in A Bubble

Since the start of 2025, I have held numerous calls with many of you as well as several of the major investment banks in the US and Europe. During these discussions, I have gathered a wealth of insights and feedback on our investment strategy. If I were to summarize the sentiment amongst both Stone Lake Wealth Management clients and these investment professionals, it would be encapsulated by the question: "Why do we own anything but US large cap technology, specifically the Mag 7?" This is a fair question, given the recent strong performance of these technology giants.

I understand and appreciate this sentiment. The allure of the Mag 7, which includes major players like Nvidia, Microsoft, Apple, and Google, has been hard to ignore, with their impressive growth and dominance in the market. However, it's essential to maintain a diversified portfolio to manage risk and capture opportunities across different sectors and regions. This is why our strategy also includes investments in European markets, emerging markets, and bonds, which provide unique growth potential and stability that can complement our US large cap holdings. As a counterpoint, consider the performance of Cisco since the internet bubble of 1999. Most of us are old enough to remember that Cisco was described as:

- The backbone of the internet.

- The seller of picks and shovels so it doesn't matter which internet company wins or loses they all need Cisco products

- Cisco is so far ahead of its competitors it will never catch up.

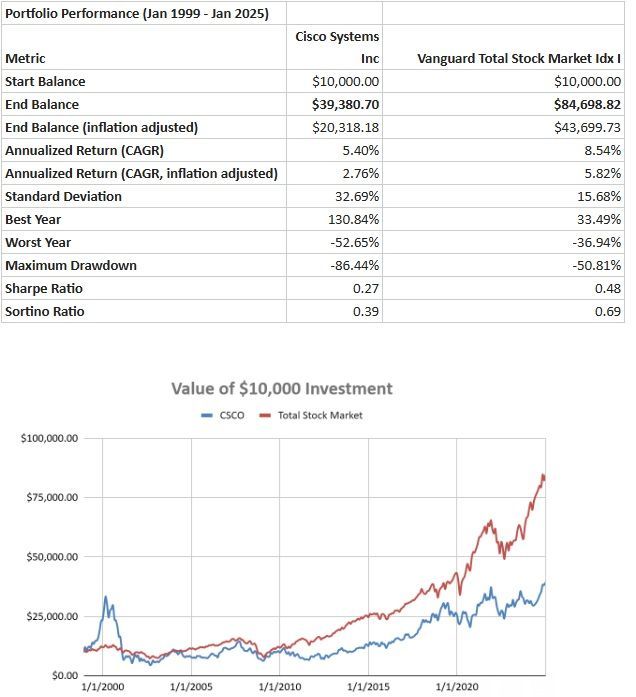

Do these descriptions remind you of a certain company today?? Despite its dominant position at the start of the internet revolution, Cisco's stock price peaked at $80.06 on March 27, 2000, and has experienced significant volatility since then. As of February 21, 2025, Cisco's stock price is $63.98. This highlights the importance of diversification to mitigate risks associated with over-reliance on a single sector or group of companies. A comparison of $10,000 invested in CSCO and the Vanguard Total Stock Market Mutual fund in 1999 results in:

While CSCO, the NVDIA of its time, generated far more excitement in 1999 than a boring, frustratingly slow investment in a Total Stock Market Index Fund it has left investors LESS THAN HALF the wealth. If you read internet boom era bank research notes or articles produced by the financial media it is truly entertaining or embarrassing depending on your point of view. It is also shockingly familiar to a lot of what is being said about today's companies and/or novel 'investments'. Here is the real irony, the majority of CSCO's return over the past 25 years has been from reinvesting the boring, steady DIVIDENDS it has paid.

If you think this story is a uniquely CSCO story then you are wrong. Go back to the 1960's and you have IBM, Kodak and the other Nifty Fifty. Go back another 30 years and you have railroad stocks, and before that steel and oil. Further back you have the South Sea Bubble, the Dutch East India Company, and everyone's favorite the Tulip Mania of 1630's.

Bubbles and mania are only truly identified after the fact and timing them is impossible. However there are some characteristics of all bubbles that I count on:

- Everyone is 'beating the market' by managing their own investments as a hobby or side gig.

- Certain stocks are 'forever' holdings.

- 20% annualized returns are considered 'normal'. Through the magic of compounding, at 20% per year a portfolio is worth 6.2 times its initial value in 10 years and 15.4 times in 15 years! I don't know anyone, retail or professional, who has actually produced returns like that. (If you do PLEASE introduce us! I will be happy to help them start a hedge fund and be first in line to invest my own money in it!)

- Uncovered frauds are ignored or explained away as 'a part of capitalism.'

- Investors start to question investing in anything else but market leaders.

- All news is good news.

- The dumber, more useless or senseless the investment, the more money it makes. (Some of us remember Beanie Babies.)

- Claims that the laws of finance have been rewritten. AKA "It's different this time"

So is my conclusion? We are definitely experiencing a bubble. Like other bubbles it is concentrated and not broad based and driven by FOMO, excitement and recency bias. Also like other bubbles the concentration of capital into the inflated assets is leaving other assets very cheap on both a relative and absolute basis. This does not mean all assets won't get hurt if/when the bubble pops but the damage will be limited and the recovery faster and to new heights for assets that are truly cheaper than their intrinsic value.

There are two ways to invest through these market cycles. Both are intuitive, simple to implement but psychologically difficult to maintain.

- BROAD DIVERSIFICATION. We don't know when or if we are in a bubble and when it will end so we buy pieces of everything and in the long run we will generate significant amounts of wealth. This approach has a long history of success backed up with hundreds of years of data. Just look at the performance of the Total Market Fund in the chart above over the past 25 years as proof.

- BUY WHAT IS CHEAP. This approach satisfies our very human bias to action and has the chance of 'beating the market in the long run.' However it also has the potential to lag behind for a very long period of time. Withstanding lagging portfolios is easier said than done when everyone else is bragging about making 20% without much work. Once again, the long run data is irrefutable.

As all of you know I strongly advocate for broad diversification. If that is your whole approach you are doing the rational and correct thing based on all the data available to give you the highest probabilities of investment success. However, for investors who simply want to be more active, myself included, I strongly believe allocating some part of your portfolio towards option 2 makes a lot of sense. A combination of the two is a solid investment approach.

The unspoken option 3 is to grab onto the bubble and YOLO your savings. While I will never advocate for this approach, if you seek entertainment and thrill via financial markets there is absolutely nothing wrong in participating with guardrails:

- Put only a portion of your portfolio towards the high fliers, i.e. the FOMO allocation. The generic advice is put in only what you can afford to lose. My hard nosed advice is put in half of that because everyone thinks they can lose more than they can actually stomach psychological.

- Keep the bulk of your portfolio in a boring, broadly diversified portfolio

- Put an amount equal to your FOMO allocation towards a value allocation. Hopefully in the long run these two extremes will produce good results.