The Reasoning Behind Our Approach and Investment Philosophy

WE SAVE AND INVEST TO ACHIEVE GOALS

People typically have many different types of goals. They can revolve around health, family and friends, careers, retirement or charitable causes just to name a few. Some goals are immediate and others can take decades to realize. Attaining any goal, regardless of its nature, requires a combination of time, effort and finances.

- Saving is the act of accumulating capital in order to address a goal’s financial requirements.

- Investing is the application of an appropriate amount of risk to savings to increase its chances of meeting a goal’s financial requirements via returns.

HOW TO INVEST: DIVERSIFICATION

Predicting which asset classes will perform best or even trying to forecast their short term performance at all has been proven to be a fool’s errand. Large of amounts of time and money have been devoted to this endeavor and the problem of uncertainty remains. For example, speculators who used to apply technical analysis to price charts manually now use algorithms, machine learning and AI. The results haven't changed. In the end markets remain uncertain and unpredictable.

Diversification is the act of distributing a portfolio across a broad swath of asset classes. If done properly, it has been shown to add incremental return while at the same time reducing the overall risk in the portfolio. By mixing and matching asset classes that behave independently we can tailor the risk/reward trade off for the unique individual and their goals. In a broadly diversified portfolio no one decision can derail the portfolio’s performance. Diversification and time are the two most important inputs to a portfolio’s long term performance. The more of both, the better.

BEST WAY TO DIVERSIFY: INDEX FUNDS

Mutual funds or ETFs based on broad indexes representing different asset classes are the most cost effective and operationally efficient way to construct a diversified portfolio.

Indexing eliminates the problem of manager selection. Time and money must be devoted to identifying criteria that predict their future performance. Academic research using decades of data has been unable to consistently identify such traits. Similar to trying to predict short term market behavior, identifying superior managers a priori has proven to be impossible.

Once selected, managers must be continuously monitored to ensure that their investment style does not drift over time. Managers are under constant pressure to outperform their benchmarks, especially during bull markets. Eventually they are forced to chase performance by buying the investment choices with the highest momentum, which means the highest levels of risk. Without careful monitoring the asset allocation of a portfolio could change surreptitiously and with serious consequences. Indexing completely removes the need to select and monitor managers and reduces the time, energy and resources needed to manage an investment portfolio.

Indexing also eliminates direct and indirect costs. Fees charged by index products are usually extremely small, mostly less than 0.1% per year. Additionally, indexed portfolios typically turnover only 5-10% of their portfolios each year vs. active managers who range from 60-80%. This reduces both transaction costs and capital gains taxes which can sap the performance of the portfolio behind the scenes. Indexing virtually eliminates two additional layers of fees for an investor working with a financial advisor.

PERFORMANCE: INDEX VS. ACTIVE MANAGEMENT

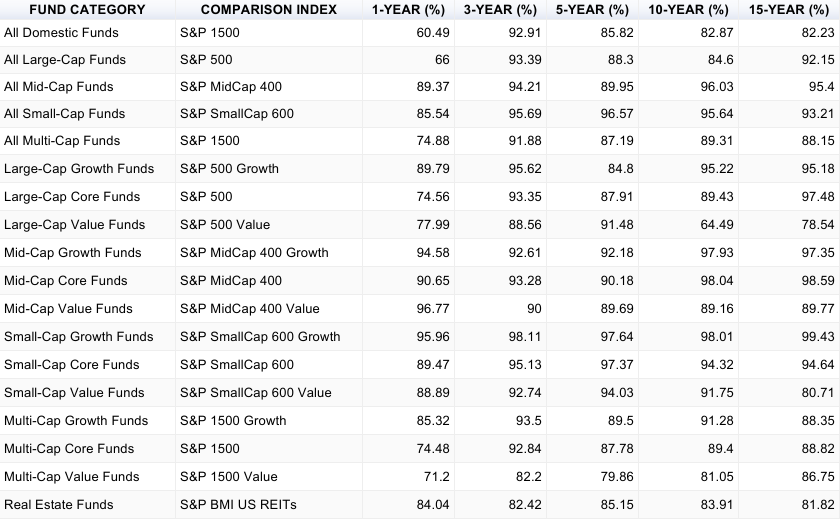

The most important reason to use index funds is performance. Decades of data have shown that active managers struggle to outperform their benchmark indexes over both short and long time horizons. The S&P Dow Jones SPIVA Scorecard is published semi-annually and tracks how active managers are performing. The following data is taken from the Year End 2016 report.

Table 1: Percentage of U.S. Equity Funds Outperformed by Benchmarks

Table 2: Percentage of International Equity Funds Outperformed by Benchmarks

Table 3: Percentage of Fixed Income Funds Outperformed by Benchmarks

REASONS BEHIND ACTIVE MANAGER UNDERPERFORMANCE

The most obvious reason for underperformance by active managers is fees. In a highly competitive, highly efficient market managers start off behind an index fund every year by charging fees 10 to 20 times higher. This difference compounds with time, making the manager’s challenge of beating their index benchmark harder as time goes on.

Market structure has also changed significantly over the past 50 years. According to Charles D. Ellis in The Index Revolution, decades ago 90% of the trading on the NYSE was done by individual investors. These people were typically non-financial professionals investing their savings with long time horizons. Today 98% of trading is done by institutions and high frequency traders. Active managers are no longer trading against amateurs, but rather sophisticated professionals like themselves.

Finally, in 2000 'Regulation FD' was implemented. It requires that all material information regarding a company be released to the entire public at the same time. Analysts or portfolio managers could no longer develop an information advantage through relationships with company management, site visits or other informal, back channel means. Full public disclosure combined with algorithmic trading has now made the market react to new information faster than any human analyst or portfolio manager can.

IMPACT OF WALL STREET MARKETING

Wall Street banks and brokers’ basic business model involves selling investments to collect fees or commissions. Like any sales operation, Wall Street employs marketing in order to reach consumers and influence demand for their products. In the 60s, when commissions were the base model for revenue, the Street came up with terms such as the 'nifty fifty' or 'one decision stocks' in order to entice people into a transaction. Later they discovered that rather than transaction based commissions, annual fees based on assets under management was a much steadier stream of income. In the 80’s and 90’s, mutual funds with star managers charging high annual management fees, front end loads (effectively commissions) and 12b-1 distribution fees became the investment vehicle of choice for most brokers. All through these phases, however, the classic definition of diversification never changed.

As the impact of competition, discount brokers and the continuously expanding data sets showing poor active manager performance made high cost mutual funds harder to sell, Wall Street realized that something needed to change. Slowly and subtly they started to change the definition of diversification from investing in different asset classes to investing via different investment vehicles. High cost mutual funds with star managers were replaced with higher cost hedge fund and private equity products that had gunslinger managers who could beat the markets due to some unknown secret sauce and skill. A diversified portfolio changed from having allocations to US stocks, emerging markets, fixed income, commodities and real estate to including allocations to alternative investment vehicles. In the end private equity is still equity, so having an allocation to both is simply a means for part of the portfolio to generate high fees, a piece of which is collected by the broker. The investor ends up with a non-diversified portfolio generating sub-par performance and containing high hidden fees.

ROBO-ADVISORS vs. HUMANS

We end with a word on the latest innovation in investment management, the robo-advisor. Modern portfolio theory implemented through technology has allowed for this new, low cost, automated means of obtaining an efficient portfolio constructed based roughly on your risk tolerances and basic, quantifiable investment goals. This is a perfectly acceptable approach for the do it yourselfer who has the time and inclination to educate themselves on the basics of investing. It also is great for people with modest portfolios and very simple finances, i.e. the young and single. In addition to portfolio construction, a human advisor can offer services and comprehensive advice a robo-advisor can not. These include:

- Understanding your unquantifiable needs and financial goals.

- Advising on your unique, complete financial situation.

- Continuous coaching and discipline to adhere to long term plans.

- Adapt to major life events and changes.

- Understand that the market’s past and the future may not look the same.

- Collaborate, explain and discuss all recommendations.

Typical robo-advisor fees range from 0.25-0.4%. Choosing the right option means making a decision on what types of services you need and want.

Sumit Kumar, Greenwich CT