ACTIVE MANAGERS UNDERPERFORM AGAIN

S&P released its semi-annual Index vs. Active Scorecard (SPIVA) for year end 2017 and it confirms yet again what academics and honest practitioners of investment management have known for decades. Active management underperforms index investing over any appreciable timeframe, during bull or bear markets, in transparent and liquid developed markets or in opaque and illiquid emerging markets . The report is extensive but I wanted to highlight some of the salient points made by its authors.

Quotes and data taken from SPIVA US Scorecard Year End 2017

“While results over the short term were favorable, the majority of active equity funds underperformed over the longer-term investment horizons. Over the five-year period, 84.23% of large-cap managers, 85.06% of mid-cap managers, and 91.17% of small-cap managers lagged their respective benchmarks.

Similarly, over the 15-year investment horizon, 92.33% of large-cap managers, 94.81% of mid-cap managers, and 95.73% of small-cap managers failed to outperform on a relative basis.

Percentage of US Equity Funds OUTPERFORMED by Benchmarks (as of Dec 29, 2017)

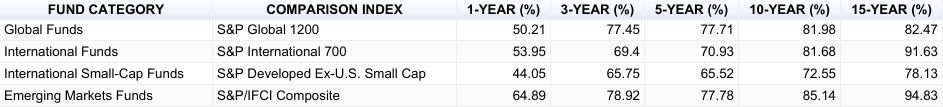

Percentage of International Equity Funds OUTPERFORMED by Benchmarks (as of Dec 29, 2017)

Active managers continue to sell investors the promise of 'beating the market' but ultimately the data speaks for itself. At Stone Lake Wealth Management we listen to it carefully, ignore the hype and slick marketing, and focus on serving clients for the long run.

For further discussion of the virtues of index investing please refer to my previous post

For further discussion of the virtues of index investing please refer to my previous post The Reasoning Behind Our Approach and Investment Philosophy.

Source:https://us.spindices.com/spiva/#/reports

Tagged: index investing, active management, investing, investment managers, investment advisor, stocks

Sumit Kumar, Greenwich CT